SBA Construction Loans: The Complete 2026 Guide to Ground-Up & Owner-Occupied Projects

What banks actually look for in SBA construction loans—and how to finance ground-up projects with less cash.

Most people misunderstand SBA construction loans—including a lot of bankers.

Some assume they’re slow, rigid, or only work for massive projects. Others think they’re just a cheaper version of a conventional construction loan. Both views are wrong, and that misunderstanding is exactly why so many SBA construction deals die before they ever break ground.

The truth is this: SBA construction loans are one of the most powerful tools available to business owners who want to build, expand, or own their commercial real estate—but only if they’re structured correctly. In this piece, I’ll break down how SBA construction loans actually work, what qualifies (and what doesn’t), and what lenders really care about in 2026—without the bank-speak or generic advice you’ll find everywhere else.

If you’re considering ground-up construction, a major build-out, or replacing rent with ownership, this will save you time, money, and a lot of frustration.

Build, expand, or own your commercial real estate — often with as little as 10% down, if the deal is structured correctly.

SBA construction loans are one of the most powerful — and most misunderstood — financing tools available to business owners. When structured properly, they allow you to build or renovate owner-occupied commercial real estate with long amortizations, competitive rates, and significantly lower equity requirements than conventional construction loans.

When structured poorly, they die in underwriting.

This guide explains how SBA construction loans actually work in 2026, what lenders really look for, and how to structure your project so it gets approved.

What Is an SBA Construction Loan?

An SBA construction loan is a loan backed by the SBA that allows a business owner to build, expand, or substantially renovate owner-occupied commercial real estate while reducing lender risk through an SBA guarantee.

Unlike conventional construction loans—which are short-term, high-equity, and often interest-only—SBA construction loans can combine:

Construction financing

Permanent financing

Long-term amortization (up to 25 years)

into a single construction-to-permanent loan structure.

Critical distinction:

SBA construction loans are designed for operating businesses, not real estate speculation.

What Types of Projects Qualify for SBA Construction Loans?

Eligible SBA Construction Projects

Ground-up commercial construction

Major renovations or expansions

Build-to-suit facilities

Tenant improvements tied to long-term occupancy

Construction combined with a business acquisition

Projects where land is already owned

Ineligible Projects

Speculative real estate development

Residential investment property

Flips or resale-driven construction

Projects without an operating business

Rule:

If the real estate primarily supports your business operations, SBA financing may be a fit.

SBA 7(a) vs SBA 504 Construction Loans

SBA 7(a) Construction Loans

Up to ~$5 million

Fixed or variable rates

Can include soft costs, equipment, and working capital

More flexible underwriting

Best for: Startups, mixed-use projects, and construction tied to acquisitions.

SBA 504 Construction Loans

Typically larger projects

Long-term fixed rates on the CDC portion

Lower rates for real-estate-heavy deals

Two-loan structure (bank + CDC)

Best for: Established businesses building or expanding owner-occupied facilities.

In some cases, hybrid 7(a) + 504 structures are used for optimal leverage and flexibility.

SBA Construction Loan Requirements (What Banks Actually Underwrite)

Owner-Occupancy Rules

Existing buildings: 51% owner-occupied

New construction: 60% at completion, increasing to 80% over time

Credit & Financial Strength

Strong personal credit (typically 680+)

Clean financial history

Adequate post-closing liquidity

Cash Flow

Ability to support debt after construction

Conservative, realistic projections

Experience & Management

Industry or operational experience matters

Strong operators outperform idea-only borrowers

Guarantees

Personal guarantees required

Additional guarantors may be necessary

SBA Construction Loan Down Payment Explained

One of the biggest advantages of SBA construction loans is leverage.

Typical Equity Injection

10%–20% of total project cost

When 10% Is Possible

Strong borrower profile

Solid contractor and budget

Stable industry

Reasonable project scope

Using Land as Equity

If you already own the land:

Its appraised value can count toward your down payment

This can significantly reduce required cash

What Increases Equity Requirements

Startups

Specialized or single-purpose properties

Limited liquidity

Aggressive projections

Example:

$3.5M total project

• $350K–$700K equity (cash, land, or combination)

• SBA-backed financing for the remainder

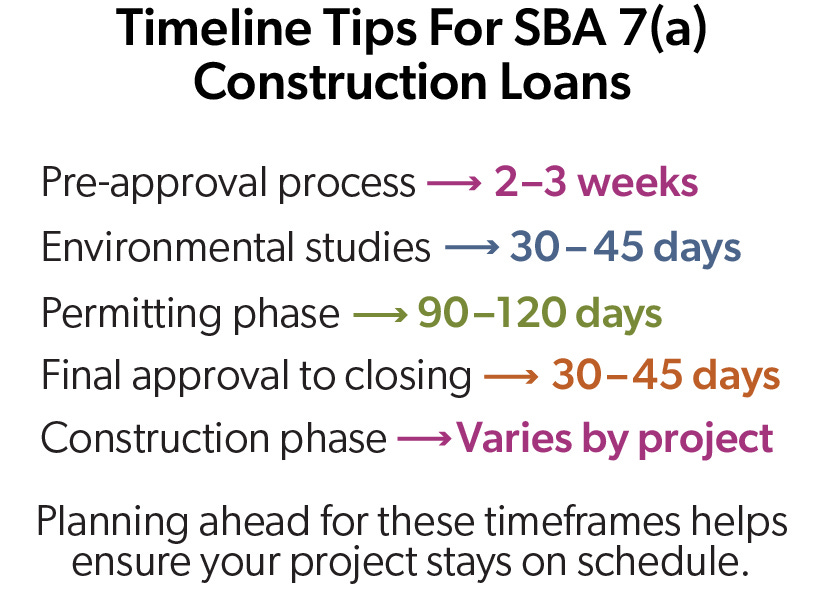

How Long Do SBA Construction Loans Take?

Realistic Timeline

Pre-qualification: 1–2 weeks

Underwriting: 30–60 days

Appraisal & environmental: 30–45 days

SBA approval: 1–2 weeks

Closing & initial funding

Total: ~90–150 days before construction begins.

How Experienced Borrowers Shorten Timelines

Complete financials upfront

Finalized contractor bids early

Conservative budgets

Correct lender selection from day one

How SBA Construction Loan Draws Work

During construction, SBA loans are typically interest-only.

Draw Process

Funds released in stages

Inspections verify completed work

Lien waivers required

Costs tracked closely

After Construction

Loan converts to permanent financing

Full amortization begins

Rate structure locks in

Cost overruns are one of the most common deal killers. Conservative budgeting is critical.

Why SBA Construction Loans Get Denied

Most SBA construction loans don’t fail because of rates — they fail because of structure.

Common Reasons for Denial

Speculative real estate intent

Unrealistic construction budgets

Weak contractor controls

Insufficient borrower liquidity

Inexperienced lenders

Poor borrower preparation

The SBA supports well-structured projects — not risky ones.

SBA Construction Loans vs Conventional Construction Loans

SBA Construction Loans

Lower down payments

Longer amortization

More flexible underwriting

Designed for owner-operators

Conventional Construction Loans

Higher equity (20%–35%+)

Short-term balloon risk

Faster closings in some cases

Less flexibility

Bottom line:

For owner-occupied businesses, SBA construction loans often produce better long-term economics, even if timelines are slightly longer.

Strategic Ways Business Owners Use SBA Construction Loans

Experienced operators don’t just build buildings — they build leverage.

Replace rent with equity

Control long-term occupancy

Stabilize operating costs

Build expansion capacity

Create exit flexibility

This is why many business owners choose to own their real estate rather than lease indefinitely.

SBA Construction Loan Example

Borrower: Operating service business

Project: $4.2M ground-up facility

Land owned: Yes (appraised at $900K)

Structure:

Land equity counted toward down payment

Minimal additional cash required

SBA 7(a) construction-to-permanent loan

25-year amortization post-construction

Outcome:

Long-term controlled facility, predictable costs, and growing equity.

SBA Construction Loan FAQs

Can SBA loans be used for ground-up construction?

Yes, if the project supports an operating business and meets owner-occupancy rules.

Are SBA construction loans fixed rate?

They may be fixed or variable depending on structure and program.

Can startups qualify?

Yes, but typically with higher scrutiny and equity requirements.

Can land be included in the loan?

Yes. Land can be financed or used as equity if already owned.

What disqualifies a project?

Speculative intent, weak cash flow, unrealistic budgets, or poor preparation.

Thinking About an SBA Construction Loan?

SBA construction loans reward planning, structure, and experience — not shortcuts.

If you’re considering ground-up construction, expansion, or owning your building, the right structure can save hundreds of thousands — or millions — over the life of the loan.

👉 See if your SBA construction project qualifies

👉 Get a construction-ready SBA assessment